Introduction:

Embarking on the journey of securing health insurance is a pivotal step in safeguarding your well-being, but the question that often lingers is, “How much will it cost?” Understanding health insurance costs is like deciphering a code, and in this blog, we aim to unravel the mystery in the simplest terms possible.

Whether you’re a first-time insurance seeker or reevaluating your current coverage, the financial aspect is a crucial consideration. This blog serves as your guide, breaking down the factors that influence health insurance costs and providing insights into how you can budget effectively. From premiums to out-of-pocket expenses, we’ll navigate through the terminology, ensuring that you gain a clear understanding of the financial commitment involved in securing comprehensive health coverage. Join us on this exploration, empowering you to make informed decisions about your health without the financial guesswork.

How are health insurance premiums determined?

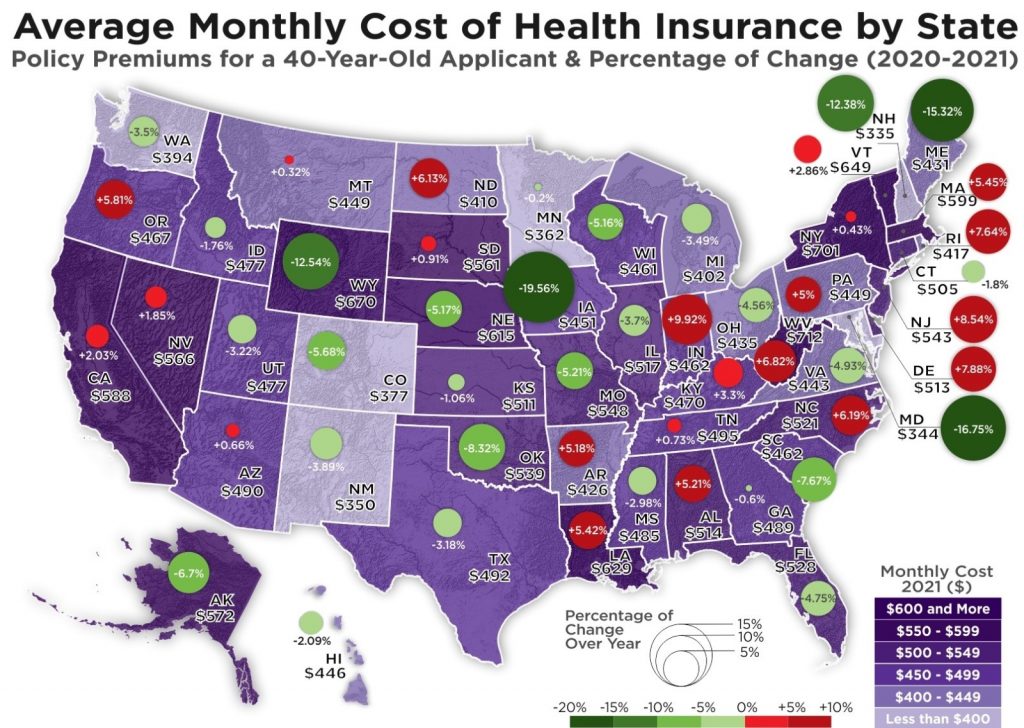

Health insurance premiums, the regular payments for coverage, are influenced by several factors. Insurers consider your age, location, and the type of plan you choose. Generally, younger individuals may have lower premiums than older ones. Additionally, the area you live in impacts costs, as healthcare expenses vary regionally. The type of plan, such as individual or family coverage, also plays a role. While premiums contribute to the overall cost of health insurance, understanding these influencing factors can help you anticipate and plan for the monthly expenses associated with your coverage.

What are out-of-pocket expenses in health insurance?

Out-of-pocket expenses refer to the costs you pay directly for medical services not covered by your insurance. These may include deductibles, copayments, and coinsurance. Deductibles are the amount you must pay before your insurance kicks in. Copayments are fixed amounts for specific services, and coinsurance is a percentage of the cost you share with your insurer. Understanding out-of-pocket expenses is crucial for budgeting, as they can significantly impact your overall healthcare costs. Knowing these terms empowers you to estimate the financial responsibility associated with your health insurance coverage.

Understanding the financial aspects of health insurance is crucial for making informed decisions about your well-being. Let’s delve into the key elements that influence health insurance costs, empowering you to budget effectively and ensure comprehensive coverage.

1. Premiums: The Foundation of Health Insurance Costs

At the core of health insurance costs are premiums—the regular payments you make for your coverage. Premiums contribute to the overall cost of your health insurance and are typically paid monthly. Several factors influence premium rates, including your age, location, and the type of plan you choose. Younger individuals often have lower premiums than their older counterparts, and where you live impacts costs due to regional variations in healthcare expenses. Choosing between individual or family coverage also plays a role, as family plans tend to have higher premiums.

2. Deductibles: Your Initial Financial Commitment

Another key component is the deductible—the amount you must pay out of pocket before your insurance coverage begins. Deductibles can vary widely among plans, and understanding this upfront financial commitment is essential for budgeting. High-deductible plans may have lower premiums but require you to cover more initial costs. On the other hand, low-deductible plans often come with higher premiums but lower out-of-pocket expenses when medical services are needed.

3. Copayments: Fixed Costs for Specific Services

Copayments are fixed amounts you pay for specific medical services, such as doctor visits or prescription medications. Unlike deductibles, copayments are set fees determined by your insurance plan. Knowing your copayment amounts helps you anticipate costs for routine healthcare services, offering predictability in your budget.

4. Coinsurance: Sharing Costs with Your Insurer

Coinsurance is a percentage of medical costs that you share with your insurance provider after meeting your deductible. For example, if your coinsurance is 20%, you’ll pay 20% of covered healthcare expenses, and your insurer will cover the remaining 80%. Understanding coinsurance is crucial for estimating your share of costs for various medical services.

5. Out-of-Pocket Maximum: Setting an Upper Limit

Every health insurance plan has an out-of-pocket maximum—a cap on the total amount you’ll pay for covered services in a plan year. Once you reach this limit, your insurance covers all remaining eligible expenses. Knowing your out-of-pocket maximum helps you plan for the worst-case scenario and provides a financial safety net.

6. Factors Impacting Costs: Age, Location, and Plan Type

Your age, location, and the type of plan you choose significantly influence health insurance costs. Younger individuals typically have lower premiums, while older individuals may face higher rates due to increased health risks. The cost of healthcare services can vary by region, impacting overall expenses. Additionally, individual and family plans come with distinct cost structures, requiring careful consideration based on your specific needs.

7. Balancing Act: Choosing the Right Coverage

Balancing health insurance costs involves selecting coverage that meets your healthcare needs while aligning with your budget. Assess your typical healthcare requirements, considering factors such as anticipated doctor visits, prescription medications, and potential medical events. Reviewing plan options and comparing costs can help you strike the right balance between premium expenses, deductibles, and other out-of-pocket costs.

8. Government Assistance Programs: Bridging Financial Gaps

Government assistance programs, such as Medicaid or subsidies through the Affordable Care Act, can help bridge financial gaps for those with limited income. Understanding your eligibility for these programs is crucial, as they provide financial relief and ensure access to essential healthcare services.

FAQS

1: How can I lower my health insurance costs?

Lowering health insurance costs involves several strategies. Consider opting for a higher deductible, which typically results in lower premiums. Shop around and compare plans to find the most cost-effective option for your needs. Utilize preventive care services to address health concerns early, potentially reducing the need for expensive treatments later on. Explore government assistance programs, like Medicaid or ACA subsidies, if you qualify. Additionally, maintaining a healthy lifestyle can lead to lower medical expenses over time, positively impacting your overall healthcare costs.

2: Are there penalties for not having health insurance?

In some regions, there may be penalties for not having health insurance, commonly known as the individual mandate. These penalties aim to encourage widespread participation in health insurance to balance risk pools. Penalties can vary, and some regions may have eliminated them, but it’s crucial to understand the rules in your area. While penalties can be a financial incentive to have coverage, the primary goal is to ensure individuals have access to necessary healthcare services, promoting overall community well-being.

Final Thoughts:

In the realm of health insurance costs, knowledge is your most powerful ally. Understanding the intricacies of premiums, deductibles, and out-of-pocket expenses empowers you to make informed decisions that align with your financial capacity and healthcare needs. While health insurance is an investment, it’s one in your well-being, providing a safety net against unforeseen medical expenses. Striking the right balance between coverage and costs involves thoughtful consideration of your health, lifestyle, and budget. Explore cost-saving strategies, leverage preventive care, and, if eligible, consider government assistance programs. Remember, health insurance is not just about expenses; it’s about securing your health and peace of mind. By demystifying the “how much” in health insurance costs, you embark on a journey where financial planning meets comprehensive coverage, ensuring that your well-being remains a top priority in every aspect of your life.